- Casualty and Social Inflation: What the latest jury trends and “nuclear verdicts” mean for casualty portfolios, and how carriers are rethinking liability strategies after multi-billion-dollar losses

- Capital and Interest Rate Cycles: Why prolonged rate softening creates both liquidity traps and balance sheet strain, and how chief executives are navigating capital deployment and investment risk

- Renewals Intelligence: Lessons from the 1/1 and 6/1 2026 renewals, and what these reveal about pricing discipline, market capacity, and the balance of power between cedants and reinsurers

- Property & Climate Risk: The aftermath of the 2025 hurricane season, secondary perils that continue to erode underwriting performance, and how risk modeling is (and isn’t) keeping pace

- Defending Returns in a Softer Market: Dialogue on abundant capital, declining rates, and strategies to preserve profitability

- A Strategic Overview of the Market including Renewal Trends, Pricing and Capacity: Including data on U.S. and global pricing cycles, renewal dynamics, and implications for 2026

- Preparing for NatCat in 2026 - Models, Uncertainty and the Next Big Loss Scenario: Secondary perils, climate attribution, and stress testing

- Parametric & Product Innovation for Resilience: How parametrics, specialty programs, and public-private partnerships are reshaping coverage for clients

- Addressing Third-Party Funding and Data-Driven Plaintiff Strategies: How litigation finance and digital advertising reshape loss costs, and insurer countermeasures

- Addressing Cyber Aggregation, From Single Losses to Systemic Events: Exploring cyber systemic exposures, casualty crossovers, and reinsurance solutions

- Exploring The Future of ILS and Alternative Capital: On appetite, structuring, and long-term role of alternative capital

- Setting out Macro & Investment Strategy for 2026 and beyond: Covering interest rates, inflation, ALM, and how investment returns support underwriting

- How AI is being Utilized at Scale: Examining considerations and potential around governance, liability, and underwriting Transformation

.png)

Navigating Volatility to Drive Profitable Growth Across the Renewal Cycle

May 12, 2026, New York Marriott Marquis, New York City

200+

Senior Attendees

40+

C-Level Speakers

The USA’s most senior Re/insurance forum

200 Senior Re/Insurance Leaders Share Strategies for Success in a Volatile Market

Right now the global re/insurance sector is heading into 2026 with cautious optimism. Market dynamics are shifting. Natural catastrophe risks are intensifying. Liability pressure continues to rise. All of this demands fresh thinking about pricing, capital allocation, product design and claims strategy.

We will explore how social inflation and adverse litigation trends are driving up U.S. liability costs. These pressures are especially acute in excess casualty and long-tail exposure. We will dig into strategies for handling nuclear verdicts, litigation funding, and structural reform of excess layers.

On the catastrophe side, wildfires in California in early 2025 inflicted insured losses of about USD 40 billion, the largest ever from a single wildfire event in the United States. Severe convective storms (large hail, tornadoes, damaging winds) added about USD 31 billion in insured losses during the first half of 2025. Together these events show clearly that wildfire and storm perils must be central to underwriting and catastrophe modelling.

At Intelligent Insurer’s Re/Insurance Outlook USA 2026, our focus will be on how reinsurers can absorb volatility and support client growth. We will present actionable case studies from recent renewals. We will address capital deployment in a competitive market. We will do deep dives into data, modelling and claims analytics. We will discuss product innovation for evolving liability and catastrophe exposures.

Building on past success, this one-day New York conference will convene senior re/insurance leaders in the U.S. including C-suite, heads of underwriting, claims, modelling, risk and capital. You will gain timely insights. You will expand your network. You will leave with perspectives that sharpen your position for the 6/1 and 1/1 renewal cycles.

At this year’s Re/Insurance Outlook USA, we will confront the issues at the heart of the industry:

Building on the momentum of our previous events, Re/Insurance Outlook USA 2026 is now firmly established as the premier strategic forum for U.S. re/insurance leadership. Last year, more than 150 executives attended, including over 50 CXOs and Presidents, ensuring every conversation took place at the highest decision-making level

This is not a trade show. It is an exclusive, senior-level meeting ground where the leaders of the re/insurance market challenge assumptions, debate solutions, and chart strategies for growth in an era of structural uncertainty

You will reconnect with trusted peers, forge new partnerships, and leave with the intelligence and relationships needed to shape your organization’s strategy in the face of profound industry change

Meet these C-level speakers at our 2026 conference :

"An excellent event, filled with timely and usable information and insights. Found several sessions to include some actionable, valuable learning directly applicable to my business"

Todd Campbell, President and Chief Executive Officer, Builders Insurance Group

With more sessions to be announced, ensure you stay up to date on the latest agenda developments by registering your interest

"The conference was excellent. The event was full of great panels, discussions and topics!"

Mauricio Betancourt, Managing Director, Travelers

Here’s who attended our 2025 conference

.png)

"The panels and presenters were top notch and well informed. The topics covered were cutting edge and the commentary was very informative. I enjoyed the day!"

Christopher Keegan, Senior Managing Director, Brown & Brown

Six Reasons to Attend Re/insurance Outlook 2026

With a full day of data and analysis specific to the USA, you’ll collaborate and problem-solve with US-based CEOs. Don’t miss this crucial networking focus in the run up to the 6/1 renewals and understand the expectations for the next quarter and the year ahead.

.png)

An agenda covering the biggest challenges in re/insurance:

Thoroughly researched with the industry’s most senior players, the comprehensive agenda presents a wide range of issues concerning the marketplace, delivered by the best minds of the re/insurance and risk sectors

.png)

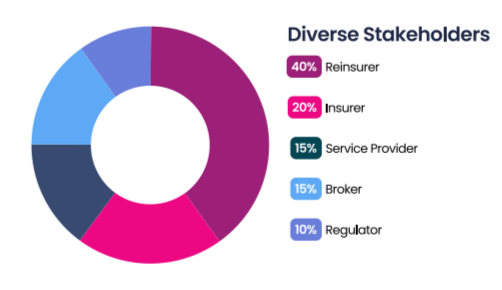

Representation from across the ecosystem:

With 150+ attendees including re/insurers, brokers, MGAs, industry bodies, business and solution providers, we bring together the entire re/insurance ecosystem for a productive discussion and fruitful networking

.png)

Be more productive in an intimate setting:

This event stands out by design - this isn’t APCIA or ITC or a massive trade show bustling with thousands of people. Re/insurance Outlook USA is an intimate setting for very senior executives, to foster meaningful connections, share ideas, reinforce relationships while engaging in valuable industry content

.png)

The perfect place, perfect timing:

Positioned at the epicentre of the USA’s economic heart and largest reinsurance hub (New York City) you’ll benefit from a US-focused event, uniting the crème de la crème of the reinsurance world. Being held in May, you’ll gauge the industry’s appetite for risk, before heading into the critical renewals negotiations. Be part of the discussion and secure your place today

.png)

The USA’s most senior-level re/insurance conference:

This is an intimate gathering where over 40% of the audience are C-level executives. No other conference provides networking opportunities of this calibre.

"I thought it was a great event, with really good speakers."

Kenneth Radigan, Chief Risk Officer, New York State Insurance Fund

Sponsors Joining us in 2026

How can you get involved

Re/insurance Outlook USA conference 2026 is organised by Newton Media

Newton Media

21-23 Elmfield Road

Bromley

Kent

BR1 1LT

United Kingdom

Email:

marketing@newtonmedia.co.uk

Speaking Opportunities

Alex Hackett

Senior Conference Producer

Intelligent Insurer

Email: ahackett@newtonmedia.co.uk

Commercial Opportunities

Jean L'Homme

Sponsorship Sales Executive, Events

Intelligent Insurer

Email: jlhomme@newtonmedia.co.uk

For help registering

Rob Lawton

Senior Delegate Sales Manager

Intelligent Insurer

Email: rlawton@newtonmedia.co.uk